Gross asset value of the portfolio*

€5.5B

Gross asset value of the portfolio*

€5.5B

*Gross asset value of Penta Investments Limited

in which the sub-fund invests.

*Gross asset value of Penta Investments Limited in which the sub-fund invests.

Penta Equity Fund

Target yield

13–15% p. a.

Minimum investment

€50K

Investment horizon

5+ years

Gross asset value*

€5.5B

*Gross asset value of Penta Investments Limited in which the sub-fund invests.

Penta Equity Fund

Target yield

13–15% p. a.

Minimum investment

€50K

Investment horizon

5+ years

Gross asset value*

€5.5B

*Gross asset value of Penta Investments Limited

in which the sub-fund invests.

Portfolio diversification

Portfolio diversification

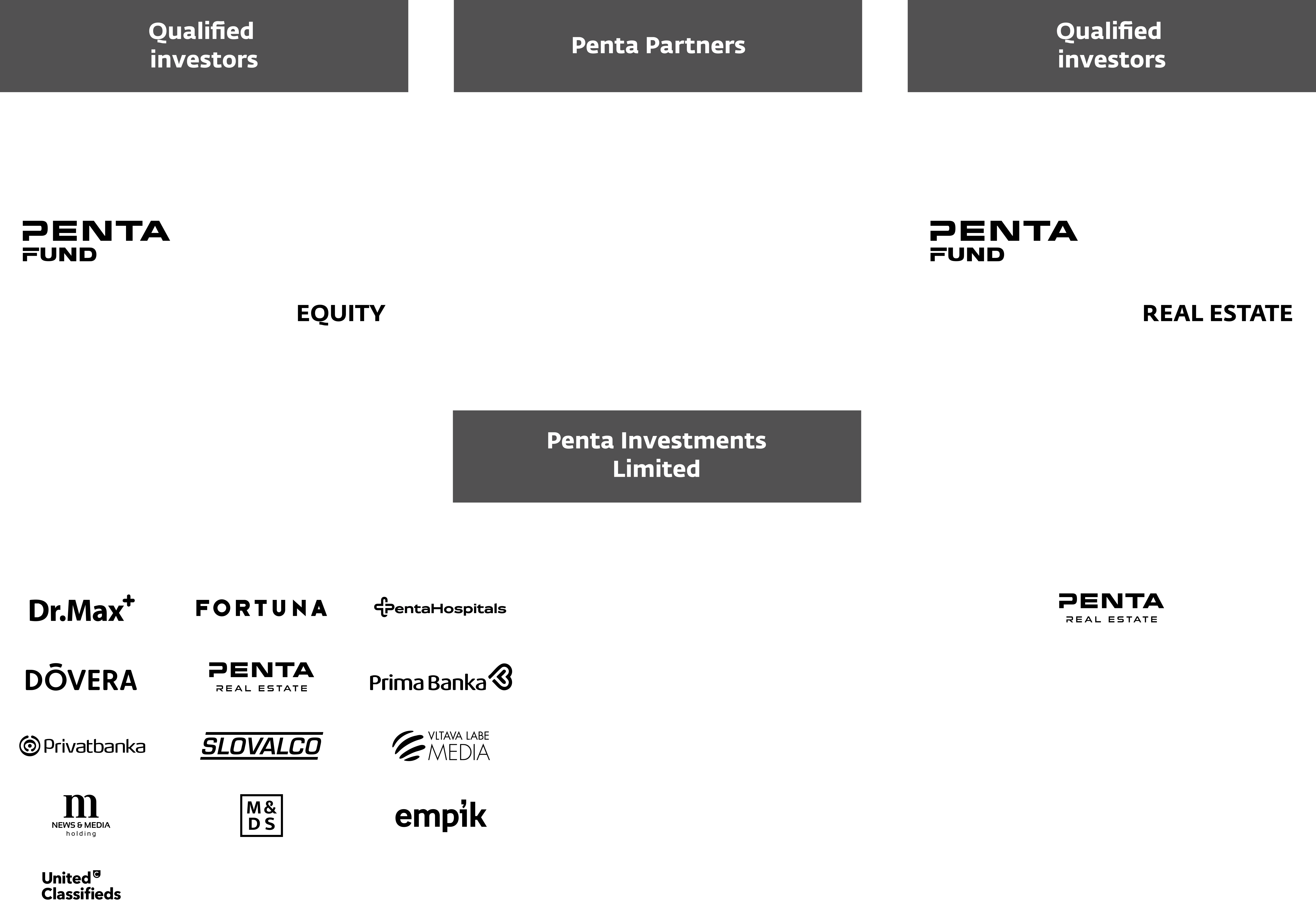

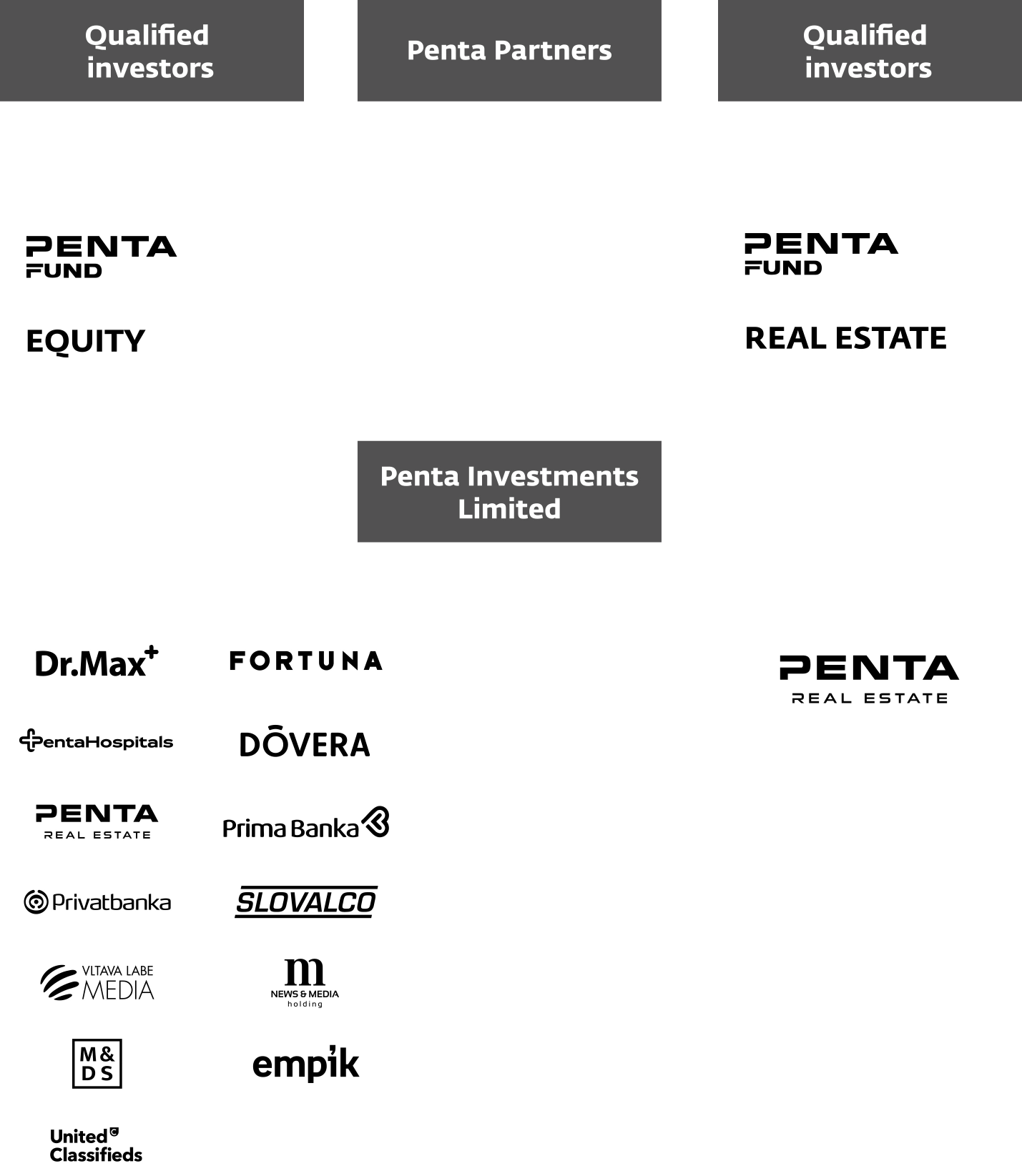

Among the most important companies in the portfolio are: the pharmaceutical giant Dr.Max, a leading betting and gaming company Fortuna, real estate developer of iconic projects Penta Real Estate and our medical facilities network Penta Hospitals. By investing in Penta Equity Fund, you partake in the success of all the companies in Penta’s portfolio.

Experience more than

30 years

Employees

50K+

Key markets

10+

Companies you will invest in

Dr. Max

Information for investors

Penta Equity sub-fund

Fund name

Penta Equity Fund SICAV, a.s.

Sub-fund name

Penta Equity sub-fund

Fund type

Qualified investor fund

Manager

CODYA investiční společnost, a.s.

Administrator

CODYA investiční společnost, a.s.

Auditor

Ernst & Young Audit, s.r.o.

Depositary

UniCredit Bank Czech Republic

and Slovakia, a.s.

Minimum investment amount

CZK 1,000,000 / EUR 50,000

Entry fee

Max. 5%

Management fee

Max. 2% p. a. of the average value

of fund capital (standard 1.6% p. a.)

Targeted yield

Establishment of the fund

30.10.2024

Investment horizon

5 years

Calculation of net asset value (NAV)

Monthly

Profit distribution

Accumulatively

Trading Day

On the last day of each calendar month

Documents for download

Information for investors

Penta Equity sub-fund

Fund name

Penta Equity Fund SICAV, a.s.

Sub-fund name

Penta Equity sub-fund

Fund type

Qualified investor fund

Manager

CODYA investiční společnost, a.s.

Administrator

CODYA investiční společnost, a.s.

Auditor

Ernst & Young Audit, s.r.o.

Depositary

UniCredit Bank Czech Republic

and Slovakia, a.s.

Minimum investment amount

CZK 1,000,000 / EUR 50,000

Entry fee

Max. 5%

Management fee

Max. 2% p. a. of the average value

of fund capital (standard 1.6% p. a.)

Targeted yield

Establishment of the fund

30.10.2024

Investment horizon

5 years

Calculation of net asset value (NAV)

Monthly

Profit distribution

Accumulatively

Trading Day

On the last day of each

calendar month

Documents for download

There are risks associated with investing. Past performance does not predict future returns. Only a qualified investor within the meaning of Section 272 of Act No. 240/2013 Coll. on Investment Companies and Investment Funds may become an investor.

Termsheet

Penta Equity

Types of investment share classes

Currency

Entry fee

Exit fee

Management fee*

Performance fee**

ISIN

Minimum investment

Profit distribution

Frequency of valuation

| C Class C EUR | D Class D CZK | I Class I EUR |

|---|---|---|

| EUR | CZK | EUR |

| max. 5% | max. 5% | max. 3% |

| 20% for 4 years after purchase, then 0% | 20% for 4 years after purchase, then 0% | 20% for 4 years after purchase, then 0% |

| 1.6% | 1.6% | 1.0% |

| 20% of appreciation above 8% p. a. High Water Mark principle | 20% of appreciation above 8% p. a. High Water Mark principle | 20% of appreciation above 8% p. a. High Water Mark principle |

| CZ0008053659 | CZ0008053642 | CZ0008053634 |

|

First purchase CZK 1,000,000 for Czech residents, EUR 50,000 for Slovak residents or equivalent in other currencies. Additional purchase CZK 100,000 or equivalent.

| EUR 1,000,000 | |

| Accumulation | ||

| Monthly | ||

*Management Fee – This is only the variable portion of the fee and includes a fixed fee to the investment company.

**Performance Fee – This is a reallocation of fund capital to Class P.

Termsheet

| Penta Equity Types of Investment Share Classes | C Class C EUR | D Class D CZK | I Class I EUR |

|---|---|---|---|

| Currency | EUR | CZK | EUR |

| Entry Fee | max. 5% | max. 5% | max. 3% |

| Exit Fee | 20% for 4 years after purchase, then 0% | 20% for 4 years after purchase, then 0% | 20% for 4 years after purchase, then 0% |

| Management Fee | 1.6% | 1.6% | 1.0% |

| Performance Fee | 20% of appreciation above 8% p. a. High Water Mark principle | 20% of appreciation above 8% p. a. High Water Mark principle | 20% of appreciation above 8% p. a. High Water Mark principle |

| ISIN | CZ0008053659 | CZ0008053642 | CZ0008053634 |

| Minimum Investment | First purchase CZK 1,000,000 for Czech residents, EUR 50,000 for Slovak residents or equivalent in other currencies. Additional purchase CZK 100,000 or equivalent. | EUR 1,000,000 | |

| Profit distribution | Accumulation | Accumulation | Accumulation |

| Valuation Frequency | Monthly | Monthly | Monthly |

*Management Fee – This is only the variable portion of the fee and includes a fixed fee to the investment company.

**Performance Fee – This is a reallocation of fund capital to Class P.

Structure of Penta Fund

Structure of Penta Fund

Investment process

Contact

the fund distributor

Fill out the form on the website or contact your private banker or advisor. Together with the distributor, you will select the optimal fund class and investment amount based on your investment strategy.

I want to investSign

investment documents

The fund is intended for qualified investors. Before investing, it is necessary to complete the investment questionnaire, AML questionnaire, and sign the subscription agreement.

I want to investTransfer

investment funds

Funds are transferred to the account of your distributor as specified in the subscription documents. The distributor will send funds to the account of the fund you have selected according to the established schedule, usually at the end of the month. The funds are then immediately invested in accordance with the fund's statute.

I want to investCrediting investment

shares to client account

Investment shares corresponding to your investment will be credited to your asset account. Investment shares will be credited within the standard period of 40 days. During the period from December to February, this timeframe may be extended due to the audit of underlying companies.

I want to investRegular reporting

and investment valuation

Each month you will receive a report on the portfolio's performance. You can also check its current value and share price directly in your investment account.

I want to investInvestment process

Contact

the fund distributor

Fill out the form on the website or contact your private banker or advisor. Together with the distributor, you will select the optimal fund class and investment amount based on your investment strategy.

I want to investSign

investment documents

The fund is intended for qualified investors. Before investing, it is necessary to complete the investment questionnaire, AML questionnaire, and sign the subscription agreement.

I want to investTransfer

of investment funds

Funds are transferred to the account of your distributor as specified in the subscription documents. The distributor will send funds to the account of the fund you have selected according to the established schedule, usually at the end of the month. The funds are then immediately invested in accordance with the fund's statute.

I want to investCrediting investments

shares to client account

Investment shares corresponding to your investment will be credited to your asset account. Investment shares will be credited within the standard period of 40 days. During the period from December to February, this timeframe may be extended due to the audit of underlying companies.

I want to investRegular reporting

and investment valuation

Each month you will receive a report on the portfolio's performance. You can also check its current value and share price directly in your investment account.

I want to investGet in touch

Fill out the form and we will get back to you soon.